The government may raise the £1m IHT cap on agricultural and business reliefs to £5m per person. Ongoing uncertainty is delaying planning and increasing risk for rural businesses.

From April 2025, the tax treatment of double cab pickups changed - and the impact for businesses is significant.

Until that point, these vehicles were classed as commercial, allowing businesses to claim 100% tax relief through the Annual Investment Allowance (AIA) on the full cost of the vehicle.

However, the rules have now changed. Double cab pickups are no longer treated as commercial vehicles for tax relief purposes, meaning full capital allowance relief is no longer available. Instead, businesses can only claim a percentage of the vehicle’s value as a deduction from taxable profits.

What the change means

The biggest impact is often felt when a pickup purchased before April 2026, which qualified for full AIA, is part exchanged for a new vehicle that now falls under the non-commercial rules.

Our Client Manager, Kate Brown, explains:

“This isn’t just a minor adjustment to allowances, it changes how taxable profits are calculated. Businesses should check how the timing of any vehicle change fits into their wider tax planning.”

She adds:

“Many businesses won’t realise that part exchanging an old pickup could push their taxable profit up significantly.”

Example

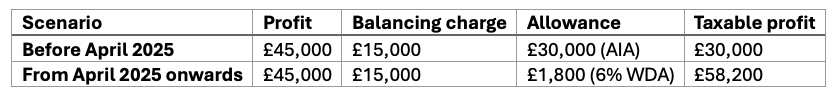

A VAT-registered business with a profit of £45,000 before capital allowances part exchanges an old pickup for a new one:

As the example shows, this change can significantly increase taxable profit, something many businesses may not have anticipated when upgrading their vehicles.

Key takeaway

If your business runs double cab pickups, it’s important to review the impact of this change on your taxable profits. The loss of full capital allowance relief can mean that changing vehicles now results in a higher taxable profit, and a bigger tax bill.

For guidance on managing the impact of these changes, Kate Brown and our team are here to help.

Contact us to discuss how your business canplan effectively.